It also generally uses a “replication” strategy when investing in the Dow but will switch to a “representative sampling” at the sub-advisor’s discretion and when it’s believed to be in the fund’s best interest. The ETF uses an options collar strategy to mitigate volatility and provide a measure of downside protection. NDJI is an actively managed fund that invests in a portfolio of securities included in the DJIA. Nationwide Dow Jones Risk-Managed Income ETF (NDJI) Expenses for DIA are also relatively low at 0.17%, allowing for minimal tracking error. DIA invests in all the stocks of the Dow and weights them comparatively to the underlying index. When most people think of an ETF to invest in, this is the one that comes to mind. It was launched in 1998 and has a history of tracking the index accurately.

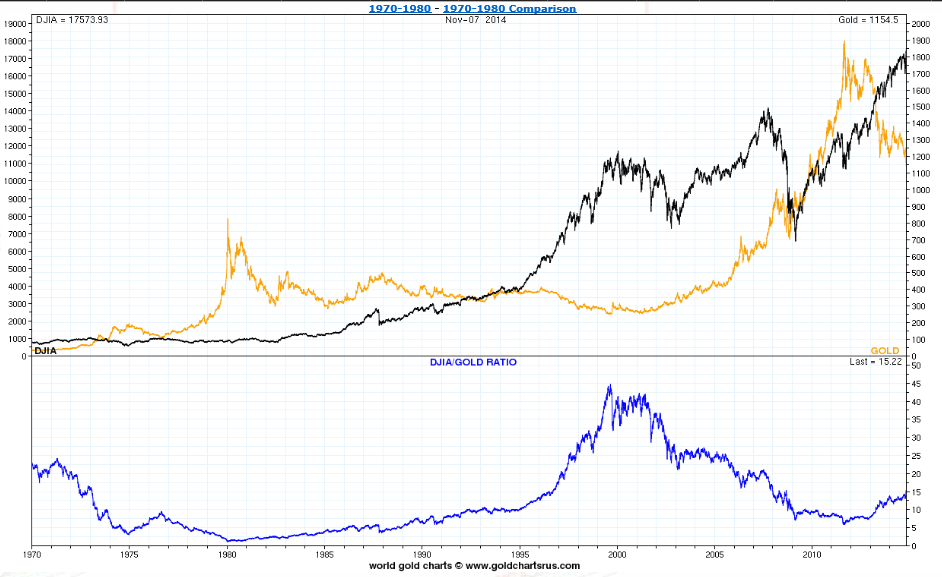

The SPDR Dow Jones Industrial Average ETF is a reliable ETF for replicating the performance of the Dow. Federal Reserve Bank of St.SPDR Dow Jones Industrial Average ETF (DIA).Excel Calculation for the S&P 500 Total Return since 1871.Online Data Robert Shiller: long term stock, bond, interest rate and consumption data.Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks. While the S&P 500 includes 500 companies, the Wilshire Large-Cap includes 750 companies. For this reason the S&P 500 Total Return from 1871 until 1977 was calculated based on Robert Shiller's data and added to the Wilshire index. Unfortunately, the Wilshire Large-Cap only dates back to 1978. Therefore, it includes all capital gains and it allows for an accurate performance comparison with Gold and Silver. In contrast to the S&P 500 Price Index and the Dow Jones, the Wilshire Large-Cap is a total return index, in which all resulting cash payouts (including dividends) are automatically reinvested back into the fund itself. Investopedia: Dow Jones Industrial Average - DJIA.Investopedia: Standard & Poor's 500 Index - S&P 500.Longermtrends: Dow to Gold ratio since 1792.Including dividends leads to a very different picture, which is demonstrated in the chart below. Therefore, they do not include dividends. Both versions of these indices are price indices in contrast to total return indices. For these reasons it is more representative of the US stock market than the Dow Jones. The S&P 500 consists of 500 large US companies, it is capitalization-weighted, and it captures approximately 80% of available market capitalization. It is one of the oldest and most-watched indices in the world. The Dow Jones is a stock index that includes 30 large publicly traded companies based in the United States. Which was the best investment in the past 30, 50, 80, or 100 years? This chart compares the performance of the S&P 500, the Dow Jones, Gold, and Silver.

0 kommentar(er)

0 kommentar(er)